Gifts of Real Estate

- Estate And Planned Giving: Professional Advisors| Gifts Anyone Can Make| Gifts That Pay You Income| Gifts of Real Estate

Gifts of real estate provide you some leverage, enabling you to save on taxes, increase your cash flow, and/or reduce the burden of maintaining or selling your property, while supporting Baptist Health Care Foundation.

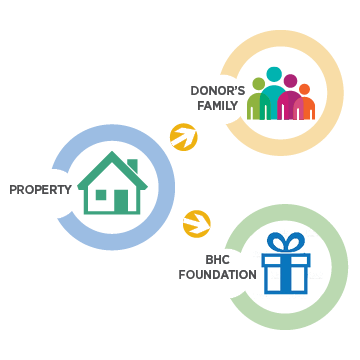

How it works:

- You deed your home, a commercial building, or investment property to the Foundation.

- The Foundation may use the property or sell it and use the proceeds for the purpose you specify.

Benefits:

- You receive an income-tax deduction for the fair market value of the real estate, no matter what you originally paid for it.

- You pay no capital-gains tax on the transfer.

- You can direct the proceeds from your gift to a specific Foundation program.

Consider a gift of real estate if you:

- Have residential, commercial or undeveloped real estate that has risen in value and that you no longer wish to maintain.

- Want the Foundation to use the property for institutional purposes or sell it.

- Own the property outright or are willing to satisfy any mortgages before donating it to the Foundation.

- Have property that is marketable and environmentally secure.

Please contact us at 448.227.8150 prior to making a gift of real estate to ensure it follows our Gift Acceptance Policies.