Gifts of Life Insurance

- Gifts Anyone Can Make: Gifts by Will or Trust | Gifts of Retirement Plans| Gifts of Appreciated Securities| Gifts of Life Insurance| Gifts of Personal Property

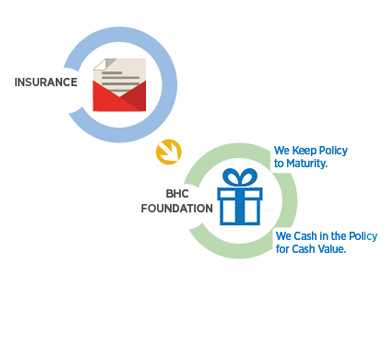

How it works:

- You transfer ownership of a paid-up life insurance policy to Baptist Health Care Foundation.

- The Foundation elects to cash in the policy now or to keep the policy and receive the death benefit later.

Benefits:

- You receive gift credit and an immediate income-tax deduction for the cash surrender value of the policy.

- In some cases, you can use the cash value in your policy to fund a life-income gift, such as a deferred gift annuity.

- You can make a significant gift now to the Foundation without adversely affecting your cash flow.

Consider a gift of life insurance if you:

- Maintain insurance coverage that your family no longer needs.

- Have few appreciated securities in your portfolio, or few that you wish to donate.

- Need a significant charitable deduction this year.

Please contact us at 850.469.7906 prior to making a gift by will or trust to ensure it follows our Gift Acceptance Policies.